Private Firm Registration Act, 2014

1. Sole Proprietorship

Sole Proprietorship is also referred to as a sole trader which is an unincorporated business that has just one owner and does business under their own name. In sole proprietorship there is no separate legal entity as it is owned by a single person. Liability and power of the sole trader are unlimited and his/her decisions are final.

Sole proprietorship is registered under 3 different regulatory bodies as per the provision of “Private Firm Registration Act 2014”.

Documents required for the registration of Sole proprietorship:

| S.N | Documents List |

| 1. | An application disclosing the following details:

|

| 2. | Copy of the Citizenship certificate of the entrepreneur. |

| 3. | Recent Passport size photo: 2 copies. |

| 4. | Other documents as prescribed by the Regulatory Authority. |

Applicable registration fee as per the Department of Commerce Supplies and Consumer Protection.

| Capital Amount | Registration Fee(NPR) |

| Upto Rs. 1,00,000/- | Rs. 1,100/- |

| From Rs. 1,00,001/- upto Rs. 3,00,000/- | Rs. 3,100/- |

| From Rs. 3,00,001/- upto Rs. 5,00,000/- | Rs. 6,100/- |

| From Rs. 5,00,001/- upto Rs. 20,00,000/- | Rs. 12,100/- |

| From Rs. 20,00,001/- upto Rs. 1,00,00,000/- | Rs. 20,100/- |

| From Rs. 1,00,00,001/- upto Rs. 5,00,00,000/- | Rs. 30,100/- |

| From Rs. 5,00,00,001/- and above | Rs. 50,100/- |

Online Registration Process:

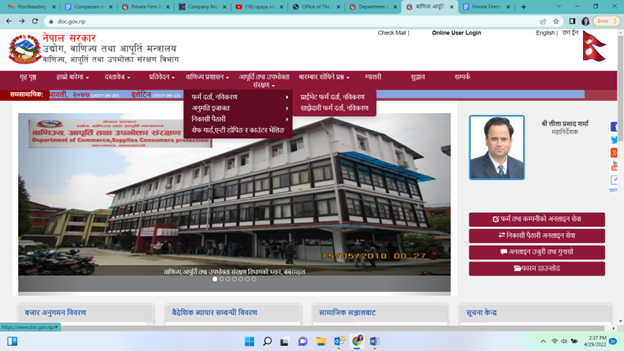

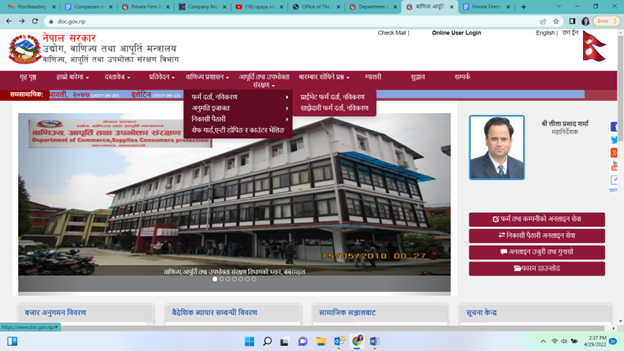

1. Enter webpage https://www.doc.gov.np/

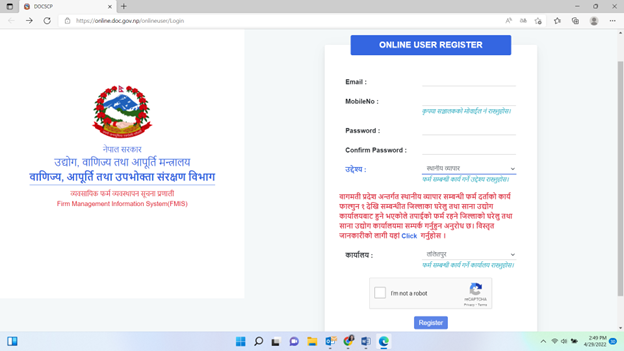

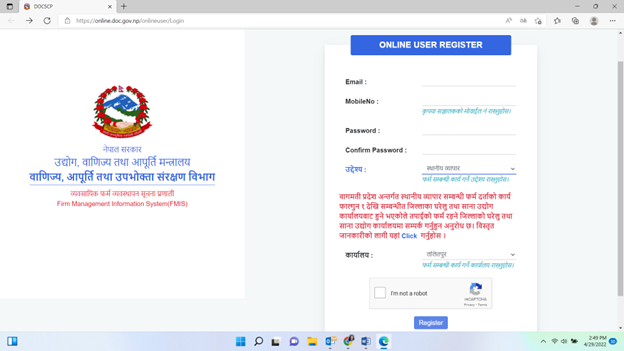

2. Create Username and ID via “ DOCSCP”

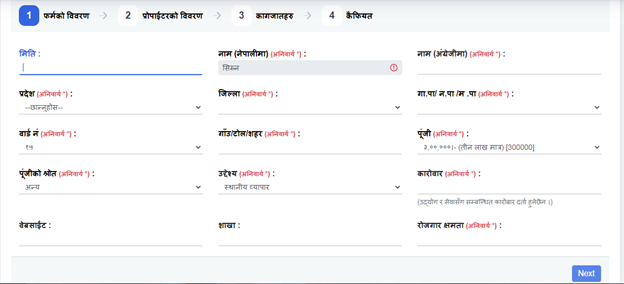

3. Fill in the details of the firm.

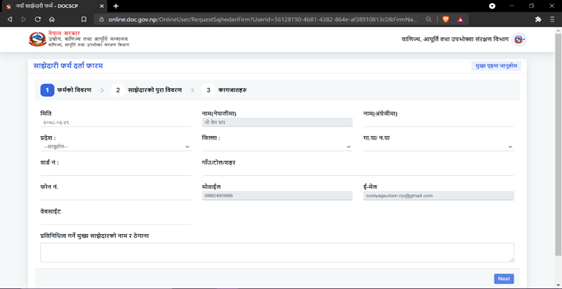

The application form requires to disclose the following information:

- Full name and address of the sole proprietorship

- Disclosure of capital

- Disclosure of the source of the capital.

- Objectives of the Sole Proprietorship

- Goods to be transacted by the sole proprietorship

- Website of the sole proprietorship

- Branch

- Employment Capacity

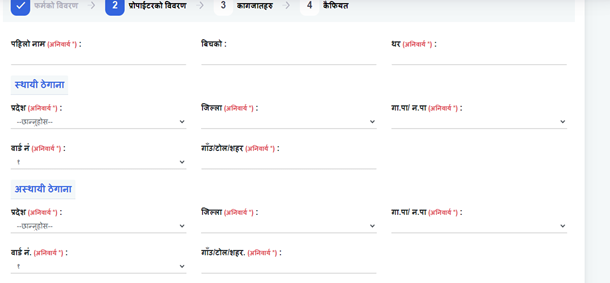

4. Fill in the details of the Proprietor

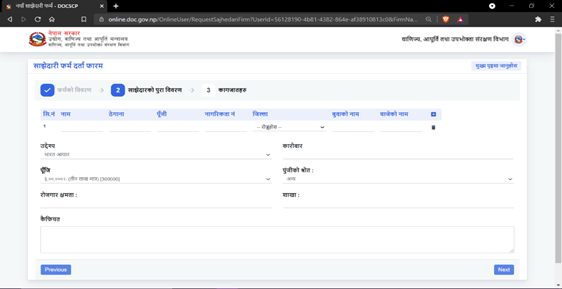

The application requires to disclose the following information:

- Full name of the entrepreneur

- Full Permanent and temporary Addresses, Gender

- Citizenship Certificate no., Issue Date and District

- Name of Father, grandfather and Spouse

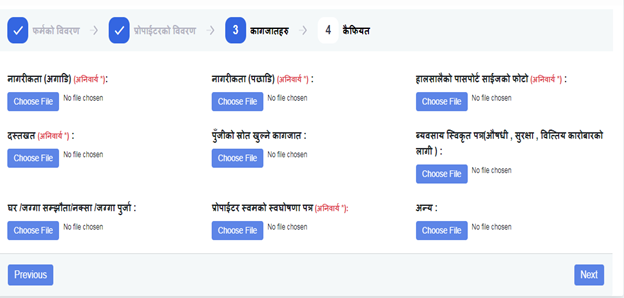

5. Upload the following documents

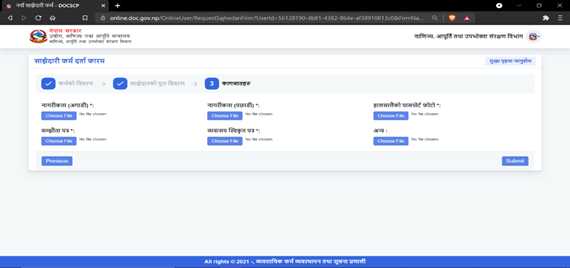

Documents List:

- A scanned copy of Citizenship Certificate

- Recent passport size photo

- Digital signature

- Disclosure of source of Investment

- Scan copy of lease or land ownership certificate

- Self-declaration of the Proprietor

The general process map to register the Sole Proprietorship are:

| Steps | Procedure |

| First | Submission of an application to the Regulating Authority along with the required documents as mentioned above and registration fee as prescribed. |

| Second | After fulfilling the online procedure, the Proprietor shall be present at the DOCSCP for the finalization of the registration procedure. |

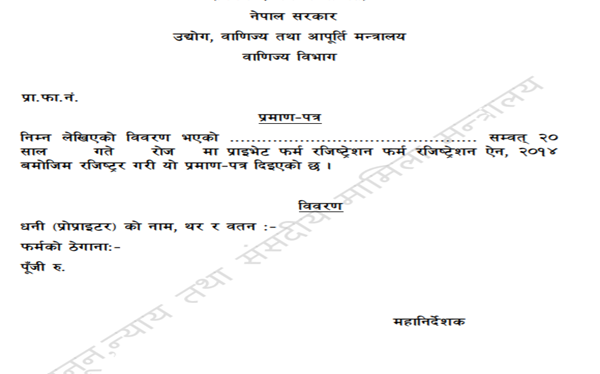

| Third | Issuance of Sole Proprietorship Registration Certificate. (Figure is shown below) |

List of documents required for the renewal of Sole Proprietorship:

| S.N | Documents List |

| 1. | Copy of PAN registration certificate. |

| 2. | Tax clearance of Last fiscal Year. |

| 3. | Audit Report |

| 4. | Original certificate of Sole Proprietorship registration. |

| 5. | Any other documents prescribed by the Regulatory Authority. |

Renewal of Sole Proprietorship

The Sole Proprietorship must renew its registration every 2 years within 35 days of expiry of the term. The applicable Renewal fees for the Sole Proprietorship are as follows:

| Capital Range (In NPR) | Applicable Fees |

| Up to Rs. 1,00,000 | Rs. 600 |

| From Rs. 1,00,001 to Rs. 3,00,000 | Rs. 1,000 |

| From Rs. 3,00,001 to Rs. 5,00,000 | Rs. 1,600 |

| From Rs. 5,00,001 to Rs. 20,00,000 | Rs. 3,000 |

| From Rs. 20,00,001 to Rs. 1,00,00,000 | Rs. 5,000 |

| From Rs. 1,00,00,001 to Rs. 5,00,00,000 | Rs. 8,000 |

| Above Rs. 5,00,00,000 | Rs. 15,000 |

2. Partnership Firm

A partnership Firm is an association of two or more persons to carry on business with combined finance, skill and ability with the purpose of operating business for mutual benefits. They share profit, bear loss and pay liability as prescribed in agreement. They jointly decide the objective of the firm, amount of capital and share of profit and loss.

Partnership firms should be registered as per the provision of Partnership Act, 2020.

Documents required for the registration of Partnership firm:

| S.N | Documents list |

| 1. | Application form in prescribed format. |

| 2. | Agreement among partners (Partnership Deed): 3 copies |

| 3. | Certified copy of Nepali citizenship certificate of each partner |

| 4. | Recent passport sized photo of each partner: 3 copies each |

| 5. | Concerned partners must be self-present with original citizenship |

The general process map to register the Partnership Firm:

| Steps | Procedure |

| First | Submission of an application form disclosing the following details:

|

| Second | Payment of registration fee: Payment should be done to the concerned department as prescribed by the law along with the application form. |

| Third | Obtaining the Registration Certificate of a Partnership Firm. |

The fee for the registration of partnership firms varies according to the provincial laws. The registration fees as per the Partnership Act, 2020, are:

| S.N | Capital Amount | Registration Fee |

| 1. | Up to Rs. 1,00,000 | Rs. 600 |

| 2. | More than Rs. 1,00,000 and up to Rs. 3,00,000 | Rs. 2,000 |

| 3. | More than Rs. 3,00,000 and up to Rs. 5,00,000 | Rs. 4,050 |

| 4. | More than Rs. 5,00,000 and up to Rs. 10,00,000 | Rs. 7,500 |

| 5. | More than Rs. 10,00,000 and up to Rs. 50,00,000 | Rs. 10,000 |

| 6. | More than Rs. 50,00,000 | Rs. 15,000 |

Online Registration Process:

1. Enter Webpage: https://www.doc.gov.np/

2. Create a username and ID via https://online.doc.gov.np/onlineuser/Login

3. Fill in the details of the firm.

The application form requires to disclose the following information:

- Full address of the Partnership firm

- Full contact details of the Partnership Firm

- Name and Address of the main partner who will be representing the Partnership firm.

4. Fill in the details of the Entrepreneur.

The application form requires to disclose the following information:

- Name, Full Permanent and Temporary addresses, Gender

- Citizenship Certificate no., Issue Date and District

- Name of Father, Grandfather and details of Spouse.

- Goods to be transacted by the Partnership firm.

- Source of Investment

- Employment Capacity

- Branch

5. Upload the following documents.

Documents list:

- A scanned copy of Citizenship Certificate

- Recent passport size photo

- Partnership Deed

- Business Approval

Renewal of Partnership:

An application form shall be submitted to the concerned department for the renewal of the firm within a period of 35 days from the date of expiry of registration.

Applicable renewal fee as per the Partnership Act, 2020:

| Capital Range | Applicable fees |

| Up to Rs. 1,00,000 | Rs. 100 |

| More than Rs. 1,00,000 to Rs. 3,00,000 | Rs. 125 |

| More than Rs. 3,00,000 to Rs. 5,00,000 | Rs. 150 |

| More than Rs. 5,00,000 to Rs. 1,00,00,000 | Rs. 200 |

| More than Rs. 1,00,00,000 to Rs. 5,00,00,000 | Rs. 250 |

| Above Rs. 5,00,00,000 | Rs. 300 |