Understanding the contribution-based Social Security Fund (SSF)

Mandated by the 1990 Constitution as a state responsibility, social security was ensured as a fundamental right by the 2006 Interim Constitution, and then by the 2015 constitution through Article 43.

In line with these mandates, the government started the collection of 1% social security tax in 2009 with plans to develop a contributory-based social security fund, developed regulations for it in 2010, and established the Social Security Fund (SSF), a dedicated autonomous government agency in 2011 to formulate and implement contribution-based social security schemes for the working class — formal sector workers at first and the rest of the working class in due course.

But it failed to design benefit schemes until 2018 leaving the 1% tax as a general revenue stream for the government.

The contribution-based Social Security Act was enacted in 2017 and the SSF finally came into effect in November 2018 during the prime ministership of KP Sharma Oli, who very well knew its political importance if not economic as full page ads ran in newspapers along with street sign boards clad with the prime minister’s photo.

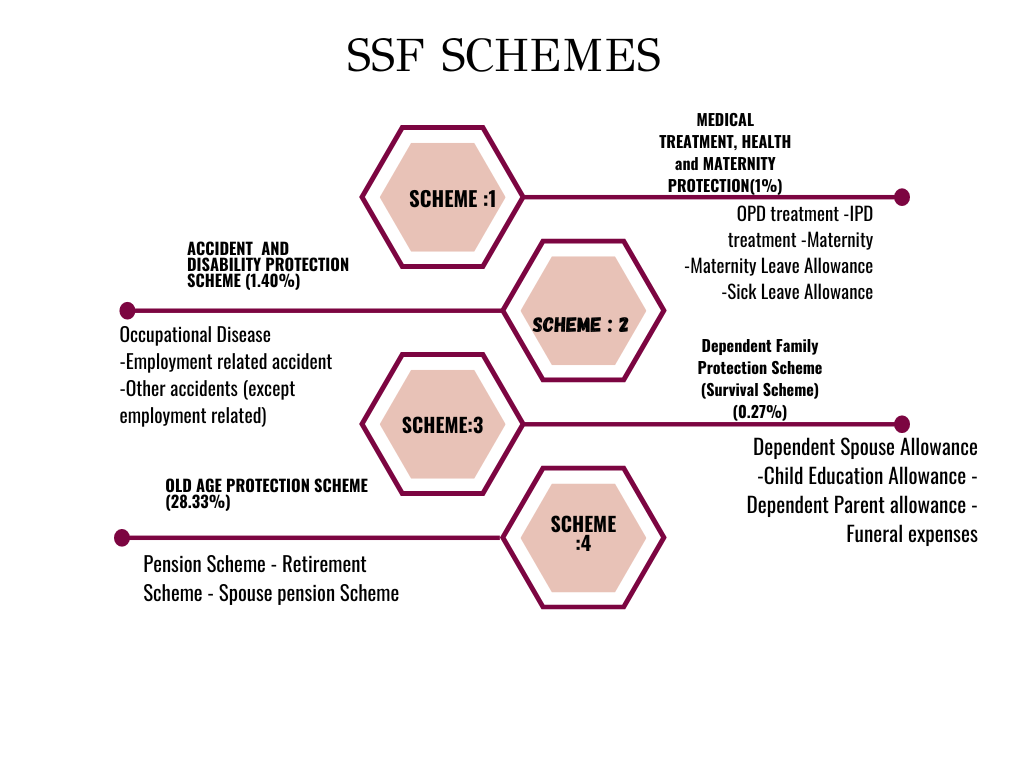

When introduced, the fund rolled out four schemes under its umbrella — i) medical treatment, health protection and maternity plan; ii) accidents and disability plan; iii) dependent family plan; and iv) old-age security plan (see chart below).

The fund has registered 389,258 contributors and 17,612 employers, collecting a fund of Rs. 28.58 billion so far (by mid-Jan 2023). It has made a claim payment of Rs. 3.24 billion, around 11.5% of the collected fund.

The fund has registered 389,258 contributors and 17,612 employers, collecting a fund of Rs. 28.58 billion so far (by mid-Jan 2023). It has made a claim payment of Rs. 3.24 billion, around 11.5% of the collected fund.

11.4% of the total payments of the total compensation are made for claims relating to scheme 1; 1.4% for claims relating to scheme 2; 1.8% for scheme 3 and 85.4% for scheme 4.

How is the SSF financed and what benefits does it cover?

The SSF is an entirely contribution-based scheme for formal sector workers.

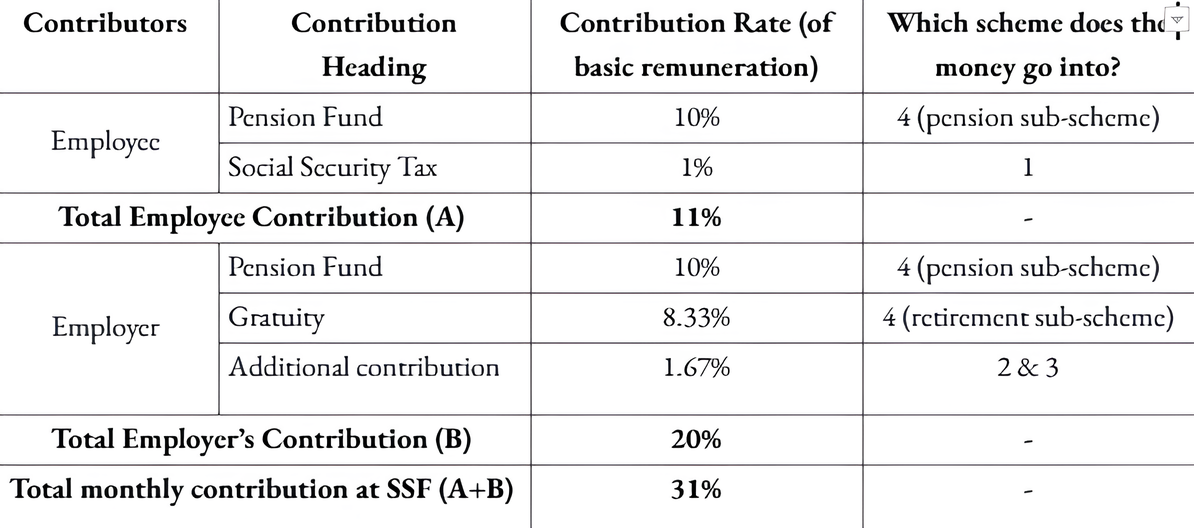

31% of the employee’s basic salary, where workers contribute 11% and their employer contributes 20%, is deposited at their respective SSF accounts. The contributed money is absorbed by different four schemes at different proportions where the retirement plan covers the largest chunk (28.33%).

Old Age Protection Plan

The old-age protection scheme helps workers secure a post-retirement life through its two sub-schemes, (a) Pension and (b) Retirement (Gratuity) allowing contributors to get a monthly pension as well as the accumulated gratuity savings at any time.

Under the pension sub-scheme, contributors will have to contribute to the fund for at least 15 years and shall receive a monthly pension after the completion of 60 years of age. In case of death of the pensioner, the spouse will get 50% of the pension amount.

Under the retirement sub-scheme, the contributor will receive accumulated savings plus returns and interest thereon, payable in one lump sum.

Medical Treatment, Health and Maternity Plan

This scheme reimburses a maximum claim amount of Rs 25,000 for OPD treatment and Rs 100,000 for IPD treatment.

Within the maternity scheme, it provides a maximum claim amount of Rs 100,000 for medical expenses incurred during pregnancy for up to six weeks of childbirth and one month minimum salary as ‘Newly born child care allowance’ for every child born. There are also provisions of maternity leave allowance and sick leave allowance.

To benefit from this scheme, three months of contribution is required. For the maternity sub-scheme, the required contributory period is 12 months within a period of 18 months.

Accident and Disability Plan

Contributors can benefit from unlimited treatment coverage against employment related accidents (medical expenses) from the first day of contribution while at least two years contribution is required for treatment coverage against occupational diseases, which will also cover all the expenses. For accidents outside the workplace, the maximum amount of coverage is Rs 700,000.

In the event of disability in any case, the contributors shall receive:

- monthly allowance of 60% of last basic salary till return to work for temporary disability

- lifetime monthly allowance of 60% of their last basic salary times the % disability (based on disability category) for permanent disability

- lifetime monthly allowance of 60% of their last basic salary for permanent total disability

Dependent Family Plan

In case of the worker’s death, the dependent/family shall be entitled to (a) allowance for dependent spouse (b) education allowance for the dependent children and (c) allowance for dependent parents and (d) funeral expenses.

The spouse will receive a lifetime monthly allowance equivalent to 60% of the contributor’s last basic salary while the deceased worker’s children will receive 40% of the basic salary (for up to 2 children on pro rata basis) as educational support until the age of 18. For deceased workers who do not have any spouse or children, their dependent parents will get 60% of their monthly salary as pension on pro-rata basis.

The family will also get lump sum amount of Rs. 25,000 as funeral expenses.

What loan facilities exist with the SSF

Through SSF, contributors can avail different loans at nominal interest rates for i) housing, ii) education iii) social functions and iv) special borrowing.

Under the credit facilities, a contributor can access a total credit facility of up to (a) salary of 15 years, or (b) salary for the period until the contributor completes the age of 60, or (c) up to Rs 10 million whichever is less, but they will have to present collateral.

Without collateral, contributors can borrow up to 80% of their deposits.

However, there are limits to borrowing — Rs. 3.5 million for education (for contributors themselves or family members); Rs. 7.5 million for housing (purchase residential building or renovation) and Rs. 500,000 for social functions such as weddings.

Eligibility requires at least 36 months of regular contribution to the fund and at least two years before retiring based on the maximum age for service. 36 months of regular contribution is not applicable for loans swapped from another approved retirement fund.

As for the nature and scope of the special borrowing, the SSF is yet to provide clarity.

How will the SSF mobilize the pooled fund

While the primary objective of social security programs like SSF is to achieve desirable social goals, the pooled fund can also serve as a source for development financing in the future.

So far, Nepal lacks large institutional funds, and SSF can fill that gap with the inclusion of compulsory savings from informal sector and migrant workers. The SSF has already pooled a fund of Rs. 28.58 billion, and is growing. The pooled funds can be mobilized to fund financially feasible large-scale development and infrastructure projects to financing SMEs.

For the moment, the government has designed a guideline identifying areas for fund mobilization.

First, loans to contributors which will provide different loans to contributors based on their needs (as explained above). Second, deposits into fixed deposits and long-term deposit schemes of commercial banks. Third, investment into debentures issued by the government and banks. Fourth, investment in equities, stock market and mutual funds. Fifth, investment into fixed assets.

What about the security of informal workers, self-employed and migrant workers?

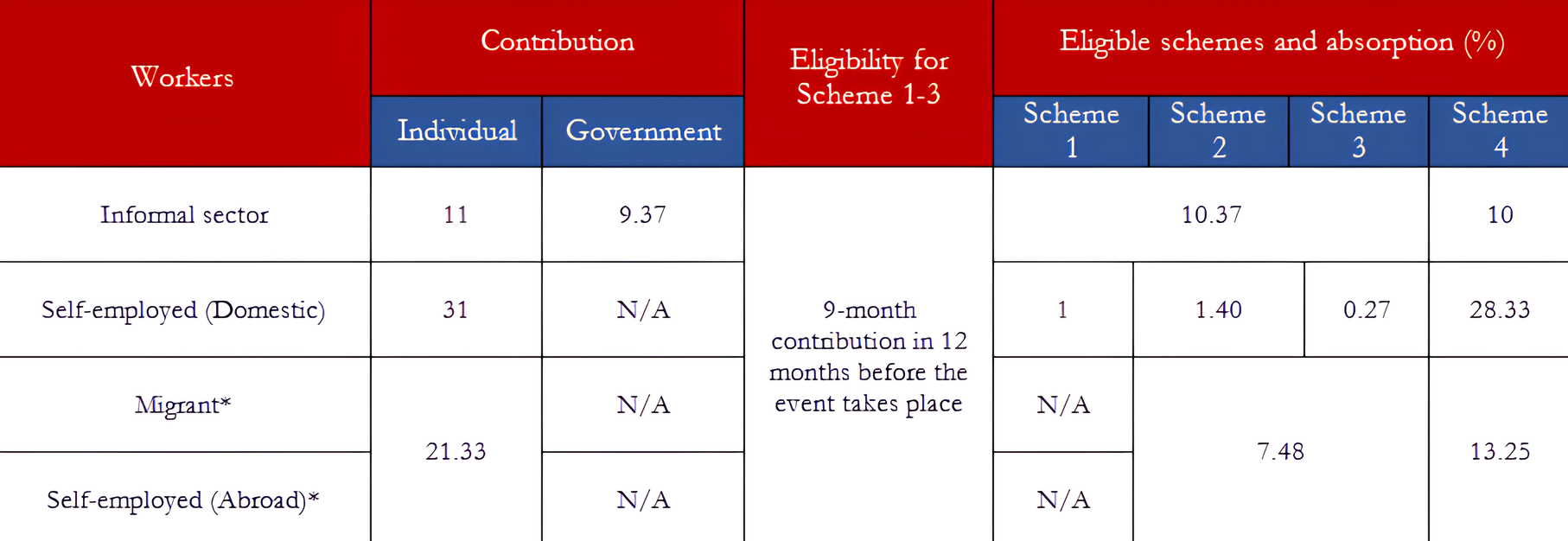

In a laudable step towards expanding the social safety net — SSF has now introduced two guidelines covering the informal sector workers, self-employed and migrant workers, which until now only covers the private sector workers.

Informal sector accounts for around 62% of the total employment in the country, according to the Nepal Labor Force Survey 2018 and employment in foreign countries constitute the largest source of employment for the country.

The guidelines have set down different contribution rates for different employment and will come into effect from 10th March for migrant workers, and 14th April for the informal sector workers.

For informal sector workers, the government will chip in a 9.37% contribution of the basic salary, while migrant workers and self-employed abroad can contribute three times their basic salary.

When compared to the formal sector workers and even within the worker’s category under the new guidelines, there are certain differences in the extent of coverage.

For instance, in case of accident and injury, the fund will cover up to Rs. 700,000 of the medical expenses for informal sector workers and self-employed individuals in the country which is capped at Rs. 100,000 for the migrant workers and self-employed individuals abroad.

Similarly, the dependent spouse will receive a lifetime monthly allowance equivalent to 40% of the contributor’s last basic salary applicable for all the workers category under the new guidelines. This is 60% in the case of the formal sector.