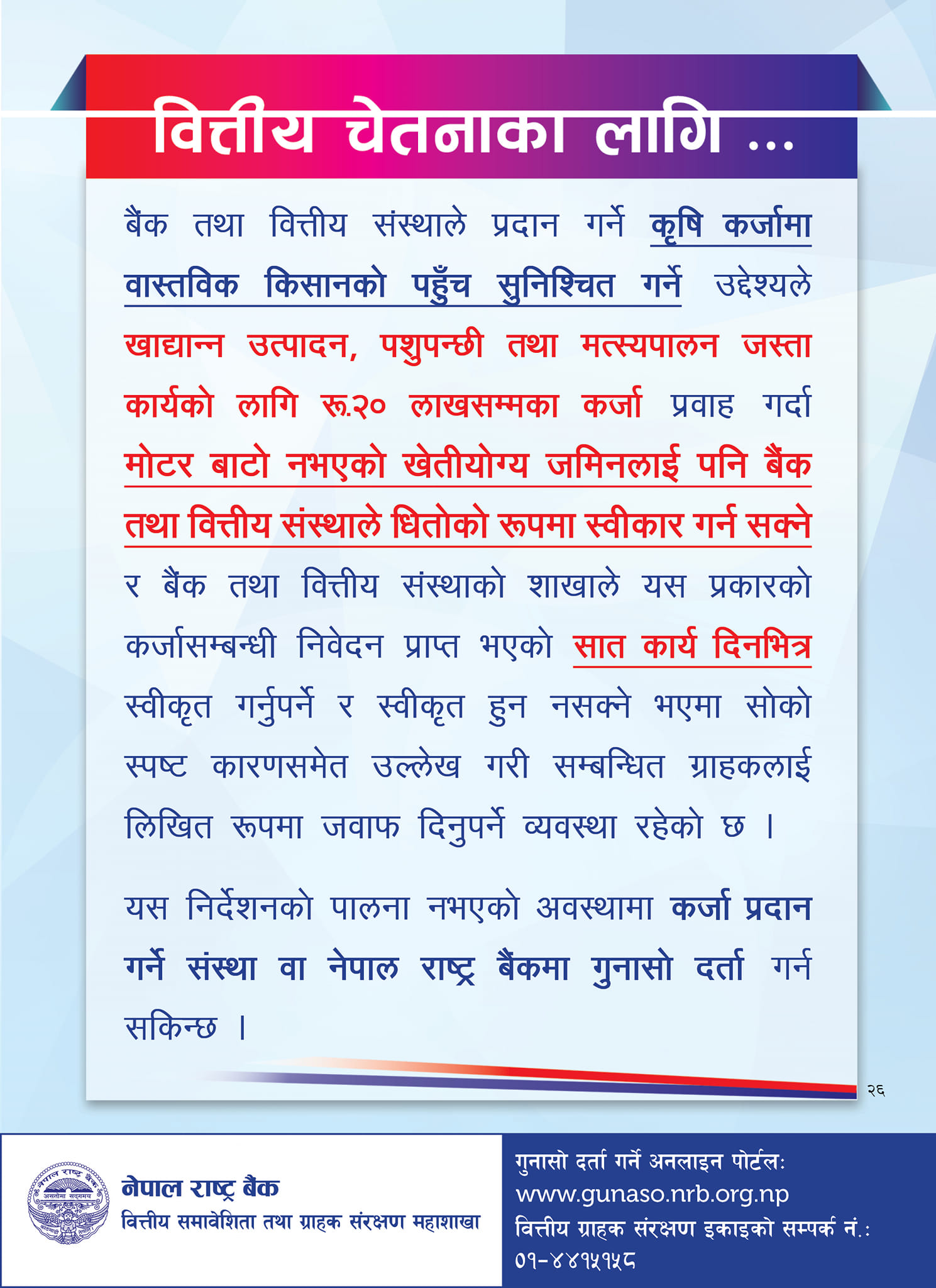

The Nepal Rastra Bank (NRB) has mandated banks and financial Institutions (BFIs) to accept agriculturally viable land without road access as collateral for agriculture loans. Farmers can access agricultural loans of up to Rs. 2 million based on their collateral.

The Financial Inclusion and Consumer Protection Division of the NRB has notified BFIs to extend loans under this provision for agricultural purposes such as food production, livestock, and fisheries.

With an emphasis on loan risk assessment, banks and financial institutions (BFIs) have been providing loans only against land with road access. Consequently, authentic farmers who own land without road connectivity found themselves excluded from financing opportunities.

The provision is introduced to ensure disbursal of agricultural loans to authentic farmers.

Loan applications of this nature should be approved within seven business days from the submission date. In cases where banks are unable to grant the loan for any reason, the NRB requires banks to present transparent clarification to the applicants.

If loans are not provided or issues arise, customers are encouraged to directly report to the NRB.