One day you decide it’s time for your business to take a growth path and go on looking out for new investment or debt, but you realize you don’t have precise numbers and documents to show them. Or, you may think you are doing good in business just because you have a good cash flow but are you making money (profits) or do you have enough assets?

Without accurate numbers or data for analysis, it becomes difficult to set growth goals — where do you stand and where do you want to reach in the next year and in the next three years?

That’s a few of the many problems you may face when you don’t have your books maintained properly.

A company is also bound to face cash flow issues, missed tax deadlines, invoicing mistakes, and other financial problems that may even result in closing the business. And even in that case, you may not be able to determine the correct business valuation.

Explore the positive impact of bookkeeping and accounting for MSMEs and their benefits:

The importance of maintaining books of accounts for MSMEs

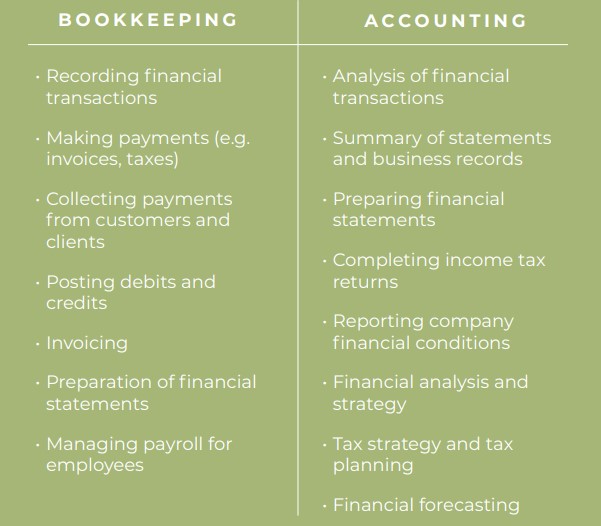

The process of regularly documenting and keeping track of financial transactions and information related to a business is known as bookkeeping.

It guarantees that the records of the various transactions are accurate, complete, and updated regularly. Maintaining books of accounts is important for MSME owners for several reasons.

Source: UNDP; Caribbean Development Bank

Accurate financial tracking: Know where you stand

MSMEs can keep a tight check on their financial operations through books of accounts.

Businesses can comprehend their cash flow and financial standing by meticulously documenting their income, expenses, assets, and liabilities. This precise financial record-keeping offers priceless information for wise decision-making, enabling companies to pinpoint their strengths, fix their flaws, and make data-driven strategic choices that are effective.

For instance, you may be holding too much stock or hiring too many people or too less. How would you know? Bookkeeping and accounting make it simple to review your financial resources and costs.

In addition, proper bookkeeping and accounting help all stakeholders, including management, investors, and financial analysts, evaluate and make financial decisions for the future success of a business.

Compliance and legal obligations

MSMEs must abide by all legal and regulatory requirements, particularly those relating to taxation and financial reporting. The process of legal compliance can be daunting for anyone starting a new business; however, the rules are really in place to protect your business.

Maintaining a proper book of accounts ensures that businesses have detailed records of tax submissions and are following legal rules. Also, substantial penalties and other legal repercussions for noncompliance may hinder an MSME’s ability to expand. Thus, implementing accounting best practices enables MSMEs to adhere to the law’s settings and foster trustworthy relationships with stakeholders.

Better financial planning and growth

Effective financial planning and sustainable growth are built on a foundation of proper records. It provides a better picture of the company’s financial health. MSMEs can determine profitability, keep track of expenses, and assess the sustainability of new initiatives or the possibility of growth by examining financial data. These insights help your business use resources wisely, reduce risks, and maximize profit.

Furthermore, investors and loan sharks rely on trustworthy financial data to determine financial standing; accurate documents make it easier for MSMEs to obtain funding or attract investors.

Tax optimization and savings

When running a business, you must pay taxes such as income tax, VAT tax, and other taxes. To determine your tax obligations accurately and to resolve legal disputes, keeping up-to-date books of account is important.

It supports MSMEs in achieving most of their tax planning strategies. Businesses may stumble upon appropriate credits, exemptions, and adjustments that lower their tax obligations. Proper tax management helps reduce unnecessary financial constraints. Further, the projected tax savings can be put back into the company or invested to boost the company’s financial standing.

Enhances risk management

It’s crucial to maintain the record books to reduce the risk of business challenges. MSMEs can spot possible risks and take preventive measures to mitigate them by keeping an eye on cash flow, analyzing expenses, and performing frequent financial analyses.

Early identification of financial fluctuations or problems enables immediate corrective measures, reducing the effect on the operations and financial stability of the business.

Improves decision-making

An accurate book of accounts provides MSME owners with real-time financial data. Businesses can review pricing structures, determine development opportunities, and figure out the profit margins of various goods and services by examining financial statements. These insights help business owners decide how to position their MSMEs for success in a competitive market.

How to maintain books of account?

MSMEs owners have the option of keeping their books of accounts in an electronic format for ease of use, precision, and confidentiality. The fact that utilizing an electronic accounting system lowers human error and saves time.

To reduce the possibility of errors, make sure all entries are legible and recorded precisely. There are some important steps to take to ensure effective financial management, regardless of whether you opt for a manual or electronic system for bookkeeping.

To properly prepare books of account, the following factors must be taken into account:

Double Entry Accounting System: A double-entry accounting system is a system for identifying errors. It is a method of bookkeeping that includes at least two corresponding entries for each financial transaction, one for each side of the transaction (debit or credit). An error occurs if the sum of the debits is different from the sum of the credits. Additionally, it guarantees that transactions are accurately recorded.

Accrual Accounting: The accrual accounting system recognizes and records financial transactions as they occur, no matter when the cash comes in or goes out. It follows the matching principle, which states “revenues and expenses should be recognized in the same period.”

Track Every Transaction: Organizing every business transaction record, such as invoices, receipts, and bank statements, is the initial act. This data will serve as the foundation for your financial report.

Record Sales and Revenue: Whether a sale is made with cash or a credit card, keep a record of every transaction. Include information like the date, the client’s name, the invoice number, the items or services sold, and the associated sum.

Bank Reconciliation: Check your accounting records and bank statements frequently. This makes sure that every transaction is accurately documented and that any disparities or errors may be promptly identified and fixed.

Manage Inventory: Set up an inventory management system to monitor the flow of items if your business sells tangible goods. To maintain a precise value and avoid surpluses or stockpiling, keep track of inventory purchases, sales, and amendments.

You can also try free and subscription-based accounting software. Khatapaana; Tigg; Deltatech and Rigo are a few Nepal-based software that offers you demo and free trial services. Other global accounting software includes Wave Accounting; Zoho Books; Zetran.