Dr. Yubraj Khatiwada, chief economic advisor to the prime minister, highlighted that existing provisions and practices excluded women from getting bank loan facilities in lack of property for collateral. He emphasised on the need to provide simple access to bank loans to all sections of society in the 36th Asian Credit Supplementation Institution Confederation (ACSIC) Conference that concluded in Kathmandu on September 25.

Organised by the Government-owned Deposit and Credit Guarantee Fund (DCGF) with Nepal hosting it for the second time in three decades, the conference focused on green financing and promoting SMEs to meet sustainable development goals (SDGs).

On another note, Khatiwada said that technological advancements could transform society as they introduce new approaches to innovative thinking and disruptive ideas. “Digital banking has been making financial services more inclusive.”

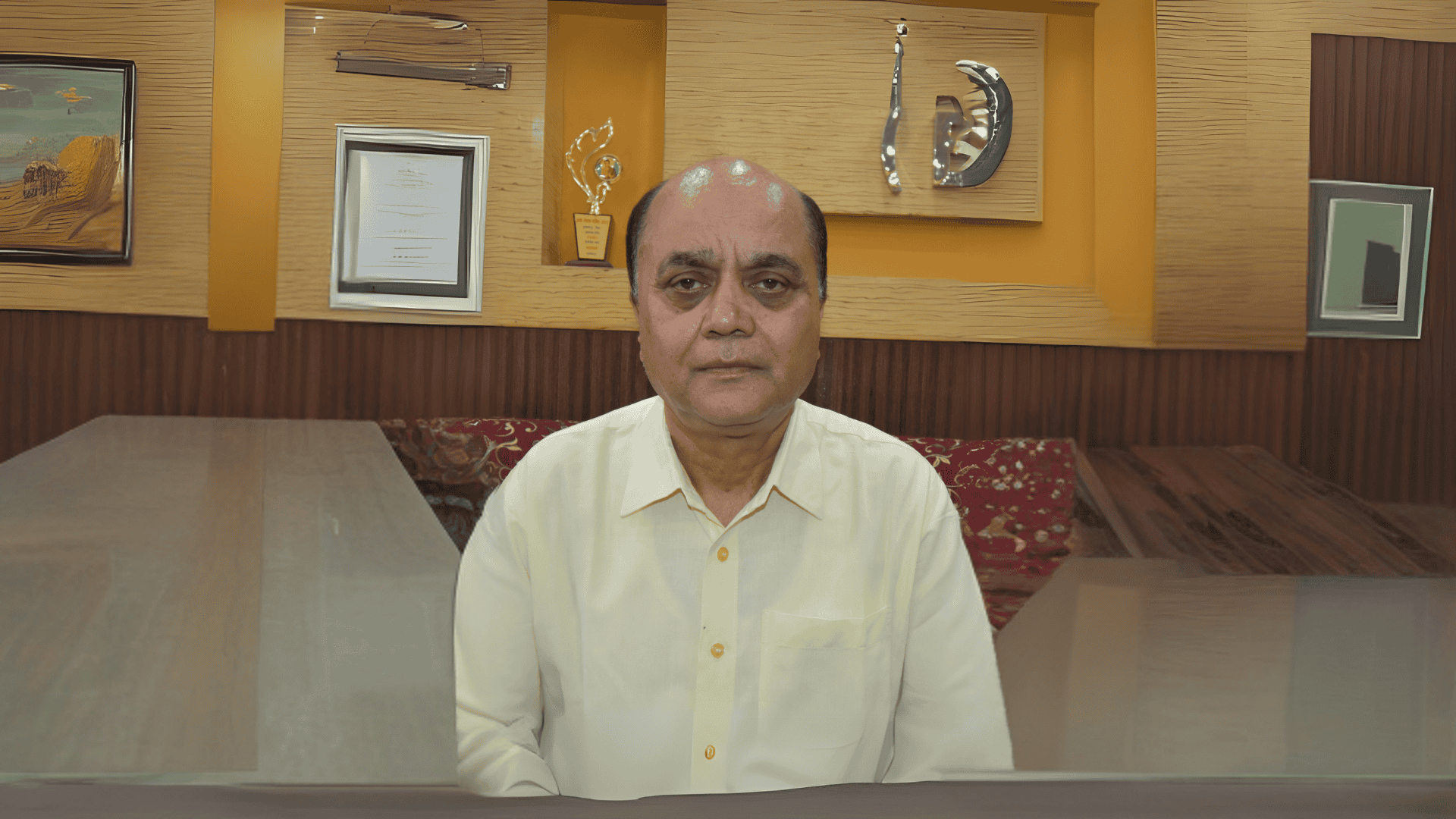

In light of emerging MSMEs and startups, credit guarantee partnership is important for making good decisions in business, said Anirvan Ghosh Dastidar, the CEO of Standard Chartered Bank Nepal. Credit guarantees could play a major part in bridging the financial gap in the country, he added by saying that 27% of the population do not have a bank account in Nepal.

“Banks have risk to directly fund in the market and that’s where credit guarantee would be helpful,” he said. “With emerging and expanding startups in Nepal, there will be more need for credit guarantee to increase the economic potential.”

Bam Bahadur Mishra, deputy governor of Nepal Rastra Bank (NRB), echoed Ghosh and asserted that credit guarantee schemes have to work very closely with their central bank to have sustainable growth across all sectors.

In plain language, credit guarantees act as an essential ‘access to finance’ tool that helps mitigate risk for lenders. These guarantees are designed to boost credit flow to sectors typically considered high-risk by financial institutions. The credit guarantee system involves three main parties: the borrower, the guarantor, and the lender, all working together to improve access to funding.

In Nepal, credit guarantee began in 1974, however, it wasn’t until 2010 that the government set up DCGF with statutory responsibility to perform both the deposit guarantee and credit guarantee function.

Mandira Thapaliya, Manager of Credit Guarantee Department at DCGF, said that DCGF is the only institution in the country providing both deposit and credit guarantees.

“With support to over 75 financial institutions, DCGF’s innovative financing products include Microfinance, Agriculture, SME, and Start-Up Credit Guarantees that have helped guarantee loans to 1.4 million borrowers with a total guarantee amount of $1.7 billion,” said Thapaliya, adding further: “Under the latest Start-up Credit Guarantee Scheme of DCGF, 1,658 applications were received, while 183 startups were selected for loans, with the provision of ensuring 75% reimbursement of the outstanding loan amount in case of default.”

In the last session themed ‘Innovative Solutions: Financing for Nature’, participants pointed out that the banks and financial institutions (BFIs) hesitate to invest in forest-based and agriculture-related ventures due to volatility in the agriculture sector.

The session also noted that green financing is new to BFIs in Nepal and stressed that blended finance is important as investors are ready to take risk as compared to other investing tools.

The session concluded by emphasising on the need for innovative financing to support the use of advanced modern technology to enhance productivity of SMEs.