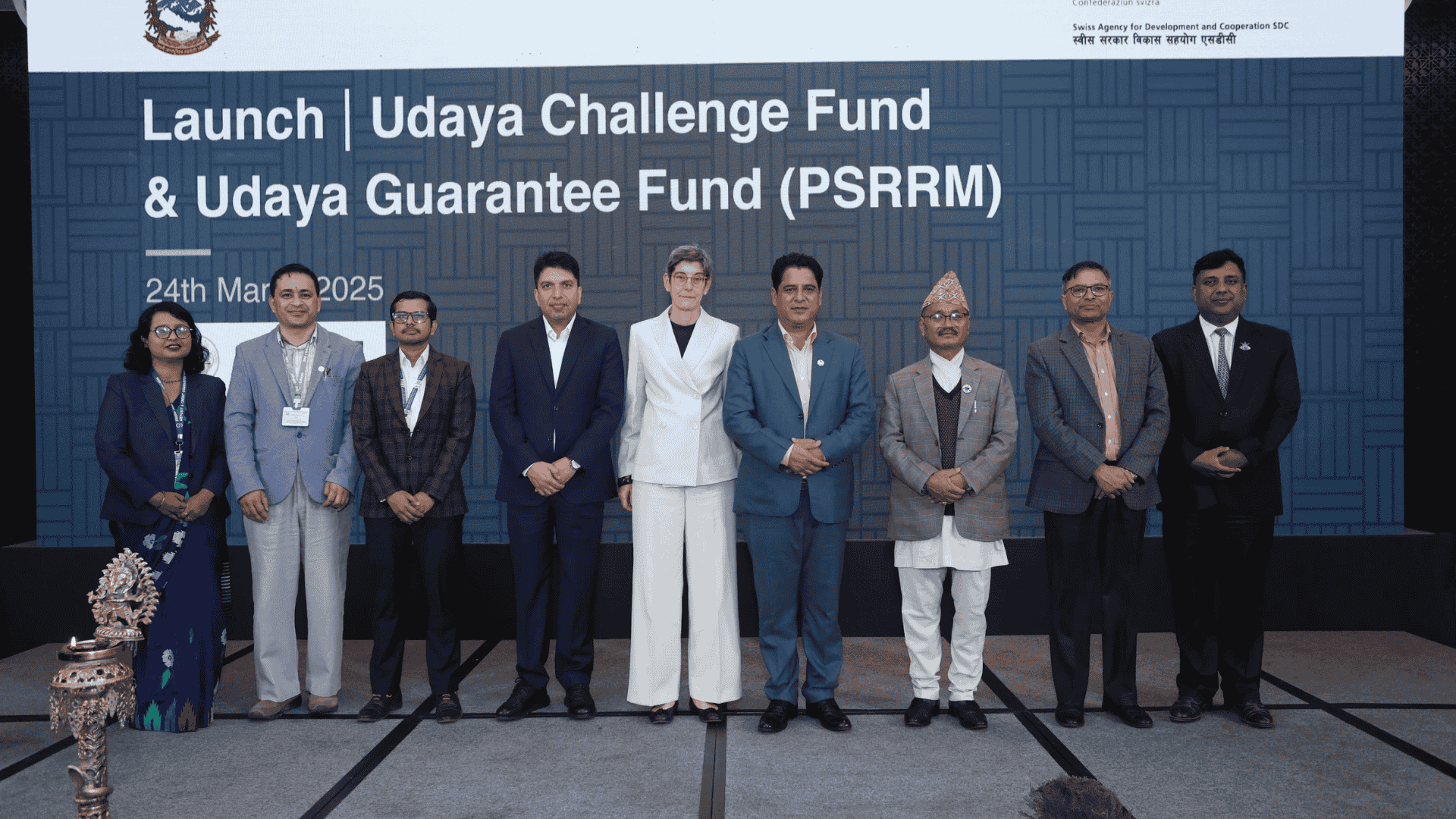

The Koshi Province government in cooperation with the Swiss Agency for Development and Cooperation (SDC) has launched the Udaya Provincial Guarantee Fund and the Udaya Challenge Fund, two different financial mechanisms focused on unlocking financing for Koshi-based SMEs.

Under the guarantee fund, the credit guarantee financial mechanism will provide partial loan guarantees to collaborating banks. This will reduce the financial risks for the institutions involved while encouraging banks to invest in the SMEs. The Koshi Province government and the SDC are jointly funding the guarantee fund with NRs 600 million, each contributing 50%.

According to the Udaya project team, ‘A’ class commercial banks will be availing guarantees from the NRs 600 million fund, which will unlock SME financing leveraging to NRs eight billion.

Additionally, there is a NRs 280 million challenge fund, which is a blended finance model that also aims to reduce lending risks for financial institutions.

Over 3,000 SMEs are expected to benefit from improved loan access.

The Udaya Project includes four key components — business development services, a technical assistance facility, a provincial SME risk reduction mechanism, and a digital information portal.

The first phase of the project, with a budget of NRs 1.149 billion, will be focused on facilitating SME growth, innovation, and capital expansion. The joint cooperation will have a budget share of 61.7% from the SDC and 38.3% from the province government.